Lets check how we can achieve this on a standard database.

Above is the fixed assets which has been disposed & its book value has now been zero.

To do this,

1. In the FA ledger entry find the sales invoice & navigate the entry.

2. After the navigate screen show the related tables where the entries have been posted,go to fa ledger entry & click on show.

3. After this you will see all of the fa ledger entries like with posting type as Proceeds on Disposal,Gain/Loss,Acquisition Cost,Depreciation.

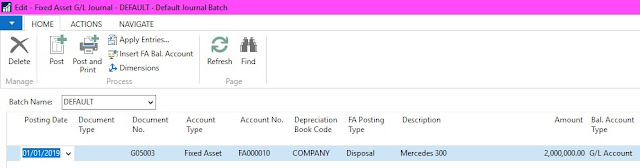

5. Go to fa gl journal there you will only see one entry, here enter the bal account type as gl account & the bal account no.

( i.e any expense account for temp use) and remove value in the bal. gen. posting type,bal. gen. prod. posting group,bal. gen. bus. posting group and post the entry.

6. After the entry has been posted you need to manually post a reverse entry to nullfy the temp expense account(i.e Dr the temp expense account & Cr the customer account that was selected at the time of posting the sales invoice for FA).

After this check your FA card & you will see that there is no check mark in disposed and more if you drill down in the book value the entries related to disposal have been moved to error ledger entries.