Creating EFW2 files

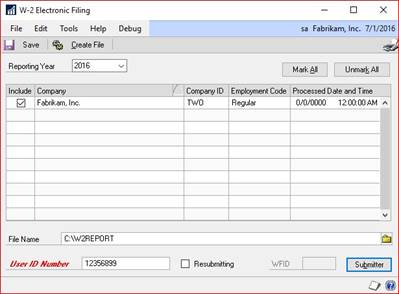

Use the W-2 Electronic Filing window to create the EFW2 transmission file and to select which companies to include in the file.

You must register with the SSA to submit the file. For information on how to register and obtain a User Identification Number with the SSA, see Obtaining a User Identification Number to submit EFW2 files electronically.

Before you begin, be sure you have completed these procedures:

-

Completed all pay runs for the year.

-

Created the Year-end Wage file. For more information, see Creating the Year-end Wage file.

-

Verified W-2 amounts on the Year-end Employee Wage report. For more information, see Printing the Year-end Wage Report.

Important

Make sure no one edits W-2 information while you're working in the W-2 Electronic Filing window.

To create the EFW2 file:

-

Open the W-2 Electronic Filing window. (Dynamics GP menu >> Tools >> Routines >> Payroll >>W-2 Electronic Filing)

When you first open the window, a message prompts you to register with the SSA to submit W-2 information electronically.

-

Enter the reporting year.

-

Mark the Include option for the first company to include in the EFW2 file.

-

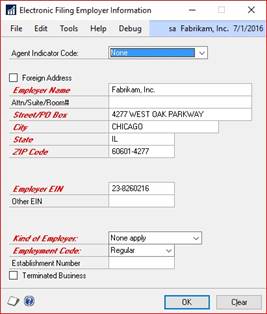

If information for a selected company is incomplete, a yellow alert icon will appear in the scrolling window heading. Click the icon to open the Electronic Filing Employer Information window. Enter the missing employer information and verify the Kind of Employer selection. Choose OK to close the window.

-

Repeat steps 3 and 4 for each company to include in the EFW2 file.

-

Enter the destination and file name for the EFW2 file. The default file name is W2Report, without an extension. If you add an extension, the SSA requires that it be a valid extension, such as ".txt".

-

Enter the User Identification Number assigned to you by the SSA when you registered to submit EFW2 files electronically. You must enter your User Identification Number before you can choose Create File. For more information, see Obtaining a User Identification Number to submit EFW2 files electronically.

-

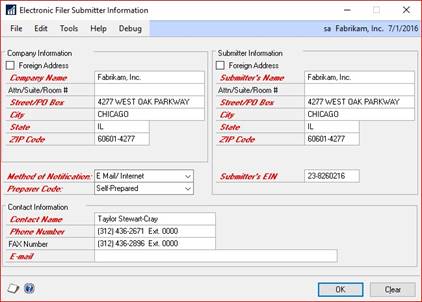

Choose Submitter to enter submitter information in the Electronic Filer Submitter Information window. To ensure that your file is valid, you must enter an e-mail address.

Address information should be no more than 22 characters per line. Excess characters will be cut off in the file.

Choose OK to save the changes and return to the W-2 Electronic Filing window.

-

Choose Create File to create the EFW2 file now, or choose Save to store the information for creating the file later. Choosing Save will also save changes in the Electronic Filer Submitter Information window.

-

If a message is displayed stating that not all fields have been entered, choose Submitter and verify that the information is complete.

The W-2 Electronic Filing Summary Report is printed after the EFW2 file is created. This report is for informational purposes only. We recommend using AccuWage to check all EFW2 files before sending. This an online submission at the SSA website.

Submitting the WFW2 files

The following guidelines summarize the filing instructions provided by the SSA. Read the SSA's instructions carefully before submitting your EFW2 file.

For information on Microsoft developers that provide electronic filing services for state taxes, see Non-supported electronic filing.

-

BSO filing

You can use the SSA's Business Services Online website to upload wage information in EFW2 format to the SSA over the Internet. To use BSO, go to www.socialsecurity.gov/bso/bsowelcome.htm.. You'll need to register for a User Identification Number to use BSO services.

-

EDT filing

You can use the Electronic Data Transfer (EDT) system to file wage information using the EFW2 format. The system connects SSA's national computer with various states, federal offices, and SSA sites. For details, refer to the Electronic Data Transfer (EDT) Guide at www.socialsecurity.gov/employer/pub.htm.